How mastering your Debt Service Coverage Ratio unlocks better financing options for your business

What is DSCR and Why It Matters

The Debt Service Coverage Ratio (DSCR) is a financial metric lenders use to determine your business’s ability to pay back debt. It compares your net operating income (NOI) to your total debt payments (principal + interest).

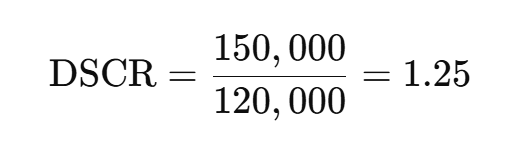

DSCR formula:

-

A DSCR of 1 means your income just covers your debt.

-

Greater than 1 means you have a cushion.

-

Less than 1 is a warning sign lenders may reject your application.

Why Lenders Focus on DSCR

Lenders want to be sure your business generates enough cash flow to repay debt without jeopardizing operations. A strong DSCR means less risk and often results in:

-

Lower interest rates

-

Larger loan amounts

-

Longer repayment terms

How to Calculate Your DSCR

To calculate your DSCR, you need:

-

Net Operating Income (revenue minus operating expenses)

-

Annual debt payments (principal + interest)

Example:

If your NOI is $150,000 and annual debt payments total $120,000:

This 1.25 ratio is typically considered a minimum for most lenders.

Ways to Improve Your DSCR Before Applying

Improving DSCR can boost loan approval chances and secure better terms:

-

Increase revenue by growing sales or diversifying income

-

Reduce operating expenses without sacrificing quality

-

Refinance existing debt to reduce payments

-

Delay new debt until cash flow strengthens

DSCR’s Impact on Different Loan Types

-

Term Loans: DSCR is critical; lenders often require 1.25 or higher

-

SBA Loans: Minimum DSCR varies; sometimes as low as 1.15

-

Asset-Based Loans: DSCR may be less critical if assets sufficiently collateralize the loan

-

Revenue-Based Financing: DSCR is less important as payments fluctuate with revenue

How Sterlas Capital Helps You Navigate DSCR Requirements

We analyze your financials to:

-

Calculate and interpret your DSCR

-

Identify opportunities to improve your ratio

-

Match you with lenders aligned with your DSCR profile

-

Structure deals that leverage strengths and minimize weaknesses

Ready to Strengthen Your Financing Position?

Understanding DSCR empowers you to negotiate better loan terms and confidently pursue capital for growth.

📩 Contact Sterlas Capital at info@sterlasvan.com to schedule a DSCR-focused funding consultation.

Let’s position your business for financial success.

Leave Your Comment Here